The easiest place to set up a

Cash Balance Plan

Identifying Potential Cash Balance Clients

Ask the business owner these 3 questions to determine if a Cash Balance Plan might be the right fit.

-

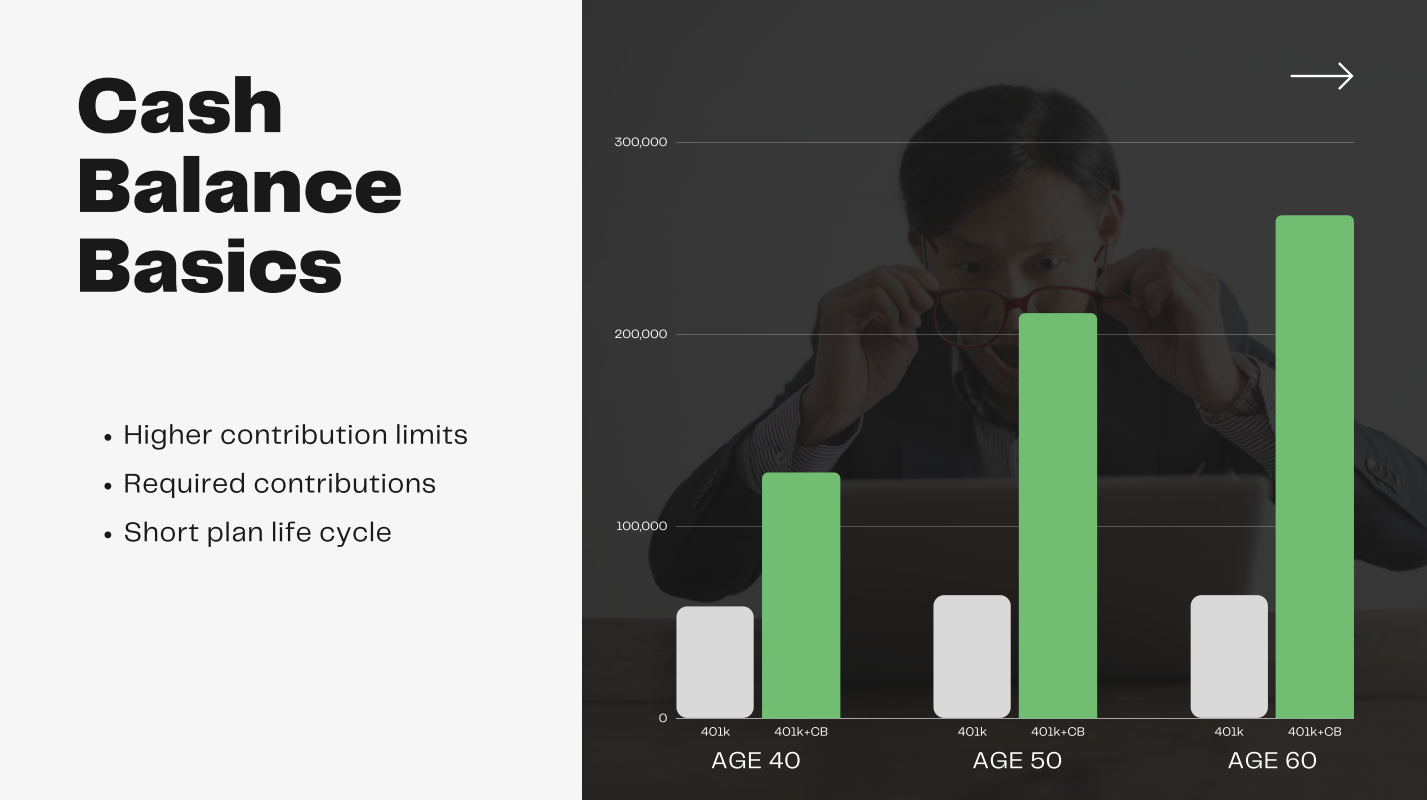

Contribution limits in Cash Balance Plans are potentially higher than in any other type of qualified retirement plan.

-

Dollars contributed to the Plan are deductible to the company.

-

Cash Balance Plans are federally protected under the Employee Retirement Income Security Act (ERISA)

The Process

After you have identified a potential Cash Balance client, follow these 3 simple engagement steps.

.

-

We’ll need to collect information like salary, date of birth, and date of hire

-

We’ll join you on a meeting with your client and their tax advisor to review and present the cash balance plan

-

You’ve introduced a huge tax lever to your client, they’ll thank you for the idea and likely set up the plan

Cash Balance + 401K Combo Plan

Cash Balance In A Box is a retirement plan product for partnerships, professional & business owners. By combining a Cash Balance Pension Plan and a 401(k) Profit Sharing Plan, business owners can take advantage of tax savings provided by both plans.

Owner-Only Plan Options

Let’s compare the other owner-only plan options to see where Cash Balance in A Box plan fits.

SOLO (k)

SEPs are super simple -they have a limit of 25% of compensation up to $61k for 2021. Compensation means different things depending on the business structure. In order to max out the contribution limit you need a high compensation and if you are an S-Corp, which most owner only businesses are, then you need a W-2 of $244k. You pay a lot of taxes with a W-2 of $244k. The opposite of what we are trying to do.

Simple Employer Plan (SEP)

The SOLO(k) has the same contribution limit as a SEP (unless you are over 50) and defines compensation the same way as a SEP. However, 401k deferrals do not count towards the 25% compensation limit. This means that you can max out a Solo k with a lot less compensation than you need to max out a SEP. The downside with a 401k is that the client needs a plan document and may have to file an annual return with the IRS.

401(k) Cash Balance Combo

The 401(k) Cash Balance combo allow for significantly higher deduction limits compared to a SEP or a SOLO(k). The downside however is that there is a minimum contribution to the cash balance plan where the SEP and Solo K are completely discretionary. By setting up 2 plans the limits are higher and there is some flexiblity as the 401(k) piece is discretionary.

Try Our Cash Balance SOLO Calculator

In less than 1 minute we can provide you with an estimated contribution. It might be more than you expect!

Examples of the Right Clients

for Cash Balance Plans

Advisor Centric

CashBalanceInABox is focused entirely on the advisor sold cash balance plan market. The platform features a portal for managing plans and a fully digital interface. Advisors bring their investment platform of choice to the table, as well as their own investment options.

This fintech cash balance TPA solution is built to smooth out the burden that advisors experience on small plans. What you get is simplified administration that makes retirement plans easy for employers and advisors while offering the lowest in administration cost this industry has ever seen.

Simple + Low Cost

Use Your Investment Platform of Choice

Our purpose is to help advisors serve their clients and provide a Cash Balance Plans with ease. We proudly claim to be the easiest place to set up a Cash Balance Plan. We are not investment advisors, so you’ll never hear us selling investments or taking asset fees. We believe it’s ideal to leave total investment control with the advisor. We also are not a custodian. Advisors often have their investment custodians and platforms of choice and we work with them ALL!

Sign up with your email address to receive news and updates.

Contact

Feel free to contact us with any questions.

Email

cbsupport@401kinabox.com

Phone

(844) 602-4015